G.I. Bills to help pay for college

If you have served in the military, you may be eligible for educational benefits under the G.I. Bill to pay for college. There are two different types of G.I. Bill assistance: Post-9/11 G.I. Bill and the Forever G.I. Bill.

For more information about the G.I. Bill and to apply for benefits, visit the VA’s G.I. Bill website.

You can use the GI Bill comparison tool to learn about programs and compare benefits by school.

Other student loan benefits and protections available to military members

If you are an active-duty member of the military, including the Reserve and National Guard, you may be eligible for certain protections and benefits related to your student loans.

In addition to the benefits listed below, it is always a good idea to ask your loan servicer if you are eligible for any additional benefits based on your military service.

Benefits and protections for military members with federal loans include:

- Cancellation: Military members and veterans may be eligible to have their loans canceled or forgiven based on their military service (under the PSLF or Perkins Loan program) or their service-connected disability (TPD program). In addition, some branches of the military provide specific loan cancellation programs to some servicemembers.

- Limits on Interest Accrual: Interest will not accrue on any Direct Loans issued after October 1, 2008 for military members who are serving in a hostile area that qualifies the service member for special pay. Borrowers with older Direct Loans or FFEL loans may consolidate into the Direct Loan program to take advantage of this benefit.

- Grace Periods: Initial grace periods can be extended for up to three years if you are called to active duty for longer than 30 days before your grace period ends. Your grace period will restart when you return from active duty.

- Deferments: Special deferments are available to military members on deployments and some other circumstances to pause student loan payments while in repayment or in school.

- Forbearances: Servicemembers and their families can also take advantage of forbearances in some circumstances.

Other Areas of Interest For Military Borrowers:

- Private Student Loans: Private student loan servicers may offer military service forbearance to pause payments on private student loans during active-duty service. Military members may also be able to pause collection lawsuits while on active-duty service.

- State Programs: Some states also have programs to help active duty military members, so that they may take a leave of absence from school without penalties. Some states also require schools to provide refunds or tuition credits to service members called to duty.

Predatory Schools & Loan Servicing: In October 2012, the Consumer Financial Protection Bureau (CFPB) issued a report about problems with student loan servicing for military service members. The CFPB also has a guide for servicemembers with student loans. Veterans and service members are often targeted by unscrupulous schools. You can get more information about this issue from the Veterans Education Success website.

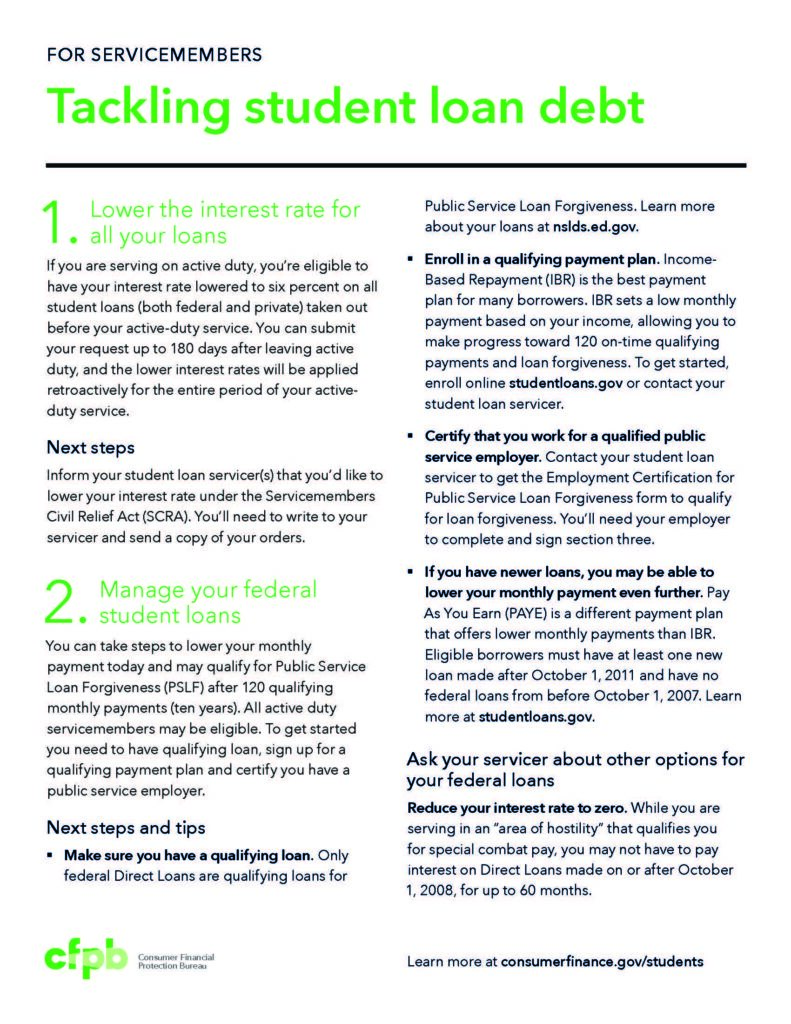

See the CFPB’s guide for servicemembers on tackling student loan debt

This guide is available for download and provides tips for military members on how to manage and tackle student loan debt.

Share Your Story

If you are a military member, spouse, or veteran, and are having issues with your student loans, let us know what you are experiencing using our Share Your Story form. NCLC regularly meets with lawmakers and policy advocates to talk about borrower issues. Your story could help us make the student loans system work for borrowers.