Note: Big changes are coming to the student loan system due to a new law and recent court cases. Key deadlines are approaching for borrowers who want to take advantage of current relief. Stay informed by signing up for updates from NCLC and checking studentaid.gov.

If you have federal student loans, you may be eligible to consolidate (combine) your loans into a new Direct Consolidation Loan. You may want to consolidate your loans if you have multiple loans and want to simplify repayment, or to make your loans eligible for certain loan repayment, relief, or forgiveness options. You may also want to consolidate your loans to get out of default. If you have a Parent PLUS loan, consolidating your loan before approximately April 2026 will give you access to an Income-Driven Repayment plan, too. However, there are some downsides to consolidation, discussed below.

Important: Recent changes to student loan law have introduced new risks to consolidating. If you consolidate and your new consolidation loan is issued on or after July 1, 2026, you will now only have access to the new RAP and new Tiered Standard repayment plans, and you will lose access to older plans like Income-Based Repayment (and if you consolidate Parent PLUS loans after that date, your consolidation loan will only be eligible for the Tiered Standard plan). Additionally, consolidating your loans now is likely to result in losing any time that you have earned toward having your loans cancelled at the end of 20 to 30 years in an Income-Driven Repayment plan.

Consolidation is similar to refinancing a loan. In both cases, you are taking out a new loan that pays off your existing loans. But consolidation is less risky because the new loan is still a federal loan with federal student loan benefits. Refinancing, in contrast, pays off your existing loans with a new private loan, and that new private loan will not have access to the same benefits.

Important: Only consolidate your loans using the federal Direct Consolidation Loan program. Consolidating or refinancing your federal student loans using a private loan refinancing or consolidation program will cause you to lose your federal student loan protections and benefits.

Direct Consolidation Loans are now the only type of federal student consolidation loan offered (although some borrowers still have older FFEL Consolidation Loans). Interest rates for consolidation loans are fixed and set based on the interest rates of the loans you consolidate.

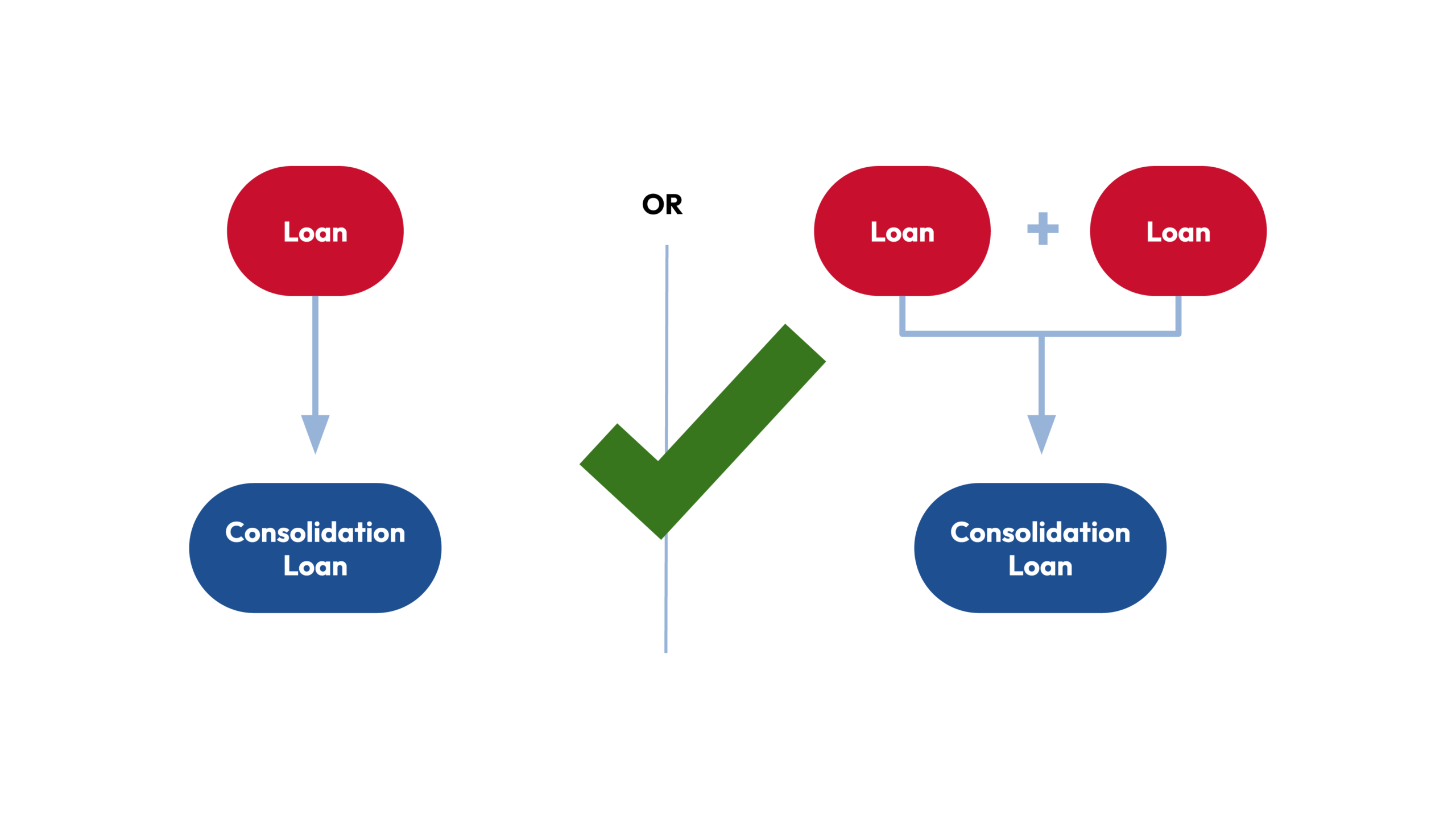

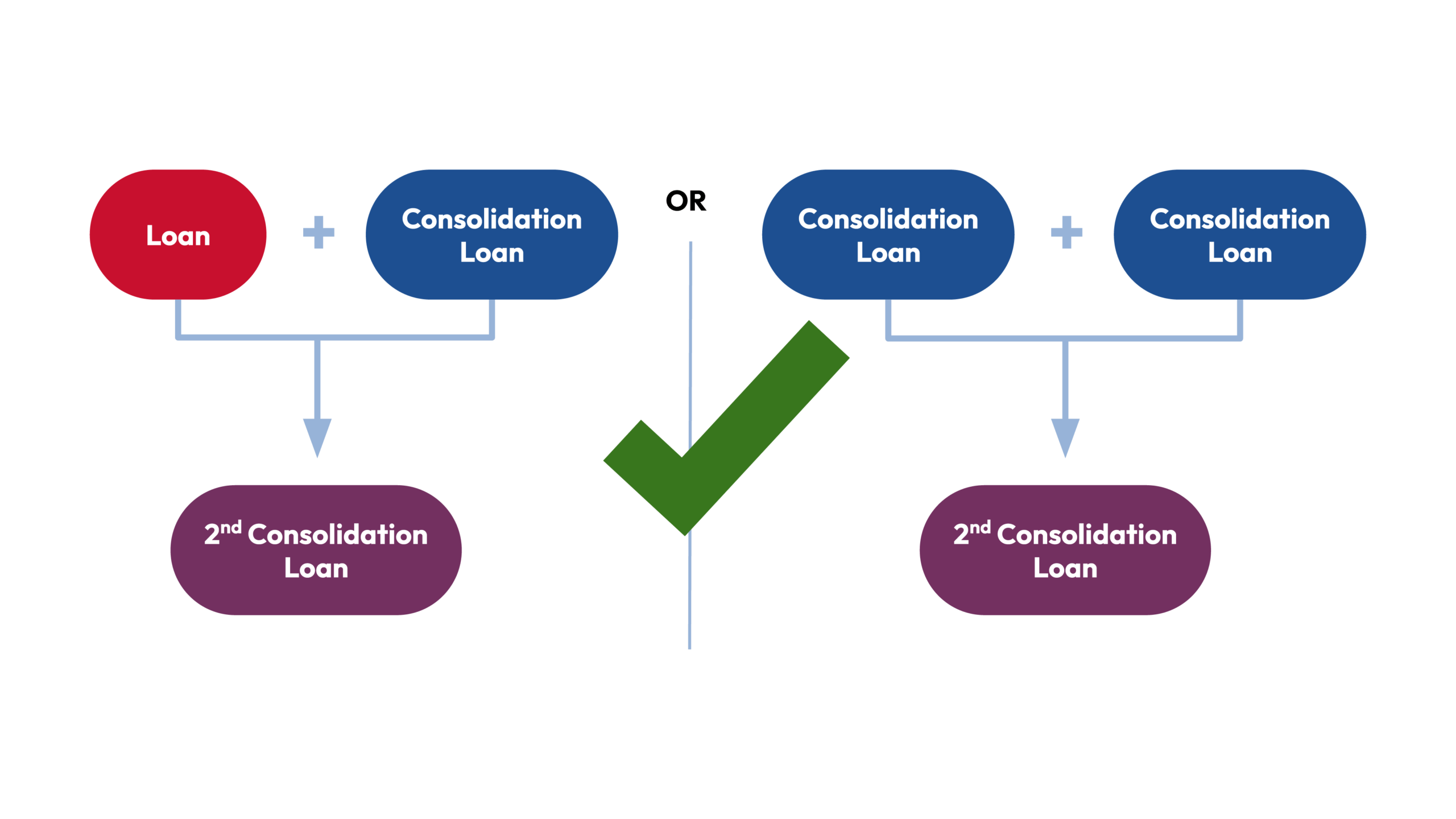

Most borrowers are eligible to consolidate their loans. Under the Direct Loan Consolidation Program, you can consolidate just about any type of federal student loan into a new Direct Consolidation Loan. You can consolidate all, just some, or even just one of your federal student loans. You can even re-consolidate a consolidation loan if you have other loans to consolidate it with. But you cannot consolidate private student loans into a federal Direct Consolidation Loan.

For example:

There are a few instances where borrowers are not eligible to consolidate their loans:

- You cannot re-consolidate a Direct Consolidation Loan on its own, unless you have another loan to consolidate it with (however, a borrower may re-consolidate a single FFEL consolidation loan to get it out of default or if the borrower indicates they intend to apply for Public Service Loan Forgiveness, and in a few other circumstances).

- If you have been sued to collect on your student debt and are subject to a judgment, you will not be able to consolidate your loans out of default unless the judgment is vacated, which a lawyer can help with.

- Borrowers whose loans are in default and are currently being collected through wage garnishment cannot consolidate until the garnishment order is lifted.

There is no fee to consolidate your loans. Beware of any company that offers to help you with consolidation for a fee, as this may be a scam. You can apply to consolidate your loans for free by completing the Direct Consolidation Loan application on the Department of Education’s website. You can learn more about how to apply to consolidate your loans here.

You should carefully consider the pros and cons before consolidating. Once you consolidate, you cannot undo the consolidation—so make sure it is the right step for you.

Note: If you previously consolidated your loans with your spouse into a Joint Consolidation Loan, you may be able to undo the joint consolidation loan. The Department of Education is still working on the process for borrowers to separate their Joint Spousal Consolidation Loans. Get more information and updates on the process on the Department of Education’s website.

Pros of Consolidating

- Combines multiple loans into one to simplify loan repayment

- Borrowers with FFEL and Perkins Loans can replace them with a Direct Loan that is eligible for more relief programs and benefits

- Borrowers with Parent PLUS loans who apply to consolidate by approximately April 1, 2026, will be eligible for IDR plans if they sign up for an IDR plan by July 1, 2028 (note: any new Parent PLUS loans disbursed or consolidated on or after July 1, 2026, will not be eligible for Income-Driven Repayment)

- Consolidating defaulted loans removes them from default (see more about consolidating out of default here)

Cons of Consolidating

- Potentially longer repayment period

- You may pay more interest over time

- You might lose certain benefits and options, including the option to use consolidation to get out of default in the future

- Consolidating certain types of loans together can limit your eligibility for some programs, but you can avoid this by leaving some loans out when you consolidate (e.g., consider consolidating any Parent PLUS loans separately from loans for your own education to keep the latter eligible for Income-Driven Repayment)

- If you consolidate any loan after approximately April 2026 and the new consolidation loan is issued on or after July 1, 2026, then you will only be eligible for two repayment plans –the new Tiered Standard plan and RAP plan (just the Tiered Standard plan for Parent PLUS borrowers)

- Consolidating loans now is likely to result in losing any time you have earned on those loans towards IDR cancellation, meaning you may have to pay your loans for more years before you’ll be eligible for IDR cancellation

- Consolidating loans with different repayment histories may impact when you’ll be eligible for PSLF.